Our Services

Business Loan

We provide a variety of business loans that include installment loans, overdraft loans, fixed-term business loans, invoice loans and equity loans.

Trade Loan

We offer a spectrum of trade loans and facilities that include letter of credit (LC) as well as trust receipts (TR).

Working Capital Loan

We offer working capital loans including secured or unsecured loans, line of credit, short-term loans and sales orders loans.

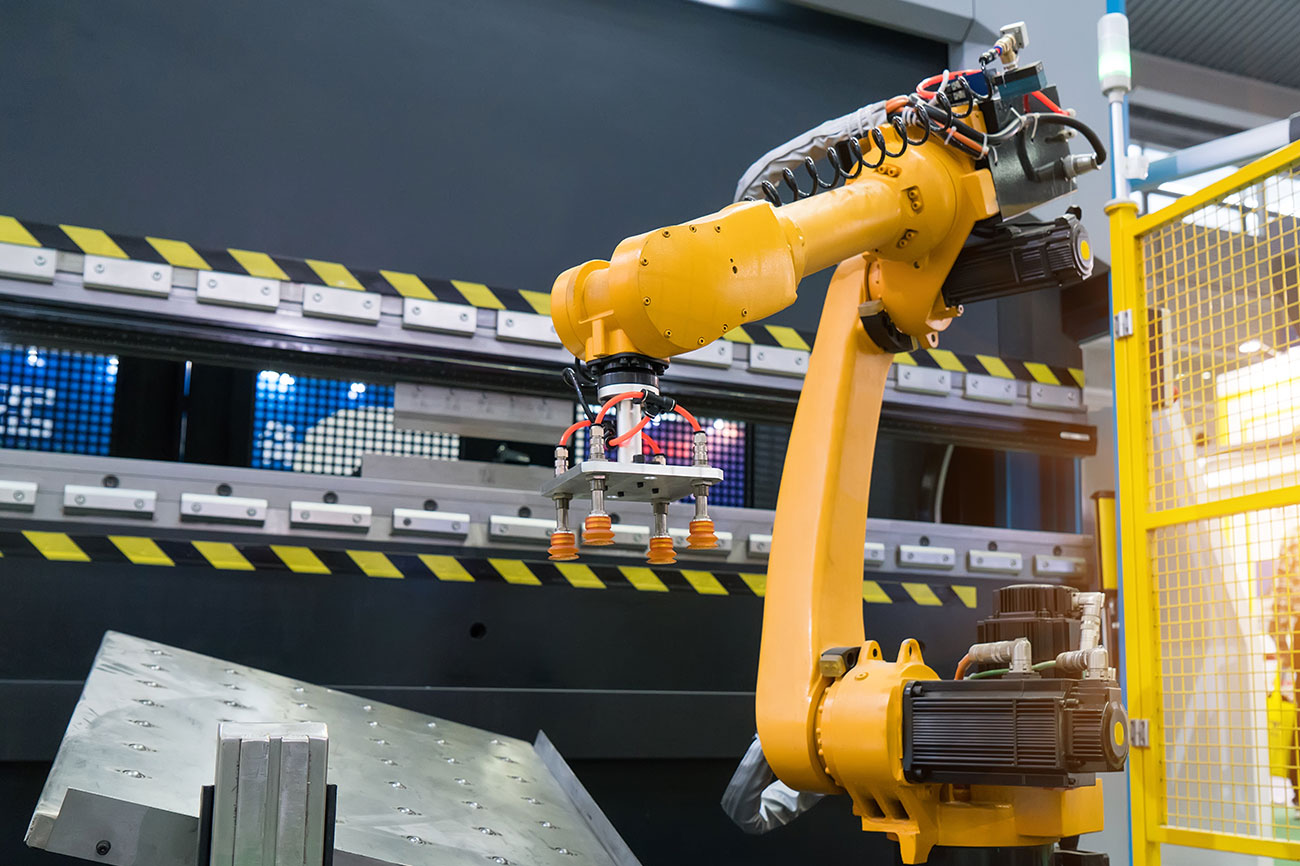

Machinery Loan

We provide financing solutions for a wide range of machinery, vessel and vehicle purchasing needs with attractive interest rates and flexible repayment periods.

Property Loan

We offer a versatile range of property loan packages, from fixed and floating rates to CPF OA rates. Our loans include refinancing loans, bridging loans, renovation loans and commercial property loans.

Who Is Eligible

- Sole-Proprietor

- Property Ownership

- Partnerships

- Private Limited Companies

- Unlisted Public Listed Companies

Testimonials

I have come to know SME Capital Group in 2018 when they successfully get my loan approved for my two working capital companies. I was amazed by their proper workflow and in-depth study of my financial situation and a group of dedicated members. I must say they are very professional, from bringing bankers, guiding me, submitting all the necessary documents to their invaluable advice, never fail to obtain the result I expected. I’ll continue to support them by introducing SME owners where the loan application is concerned. Thank you, Vincent!

When I was approached by Vincent, I had already applied for a loan from my operating bank, but still, I gave him a chance to serve… To my surprise, two weeks later he drops by my place with a banker and he manages to get double the loan amount than my operating bank can offer… Now, whenever comes to loan matter, SME Capital Group will be the first choice on my mind. I’ve shared this experience with friends and associate,they are all very pleased to work with him and his team. Thanks to Vincent, you are great!

To share my experienc when taking a loan with SME CAPITAL GROUP.

SME CAPITAL GROUP will be my first choice when getting a loan for my business. Mr. Stanley Tan, professional assistance in this field, apply faster for my business, and secure the loan from the bank. With the hard work and his network in this area, I can run my business smoothly without having to, search and investigate the matter.

At the same time, I also introduced my business partners to him, and they also obtained the loans as fast as I am, thanks to SME CAPITAL GROUP!

ERIC CHAN

Director

Why Choose Us

At SME Capital, we are customer-centric have a long track record of financing companies across the various industries. Our pricing is based on value and we focus on maximizing the amount of money you receive no matter the purpose of the loan.